I have looked

over the last five general elections and analysed in detail what happened to

the property market on the lead up to and after each general election. This

gives us some very interesting information.

Of the last

five general elections (1997, 2001, 2005, 2010 and 2015), the two elections

that weren’t certain were the last two (2010 with the collation and 2015 with

unexpected Tory majority). Therefore, I wanted to compare what happened in

1997, 2001 and 2005 when Tony Blair was guaranteed to be elected/re-elected

versus the last knife edge uncertain votes of 2010 and 2015 ... in terms of the

number of houses sold and the prices achieved.

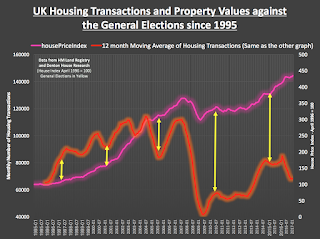

Look at the first graph below comparing

the number of properties sold and the dates of the general elections.

It is clear, looking at the number

of monthly transactions (the blue line), that there is a certain rhythm or

seasonality to the housing market. That rhythm/seasonality has not changed

since 1995 (seasonality meaning the periodic

fluctuations that occur regularly based on a season - i.e. you can see how the number of properties sold dips around

Christmas, rises in Spring and Summer and drops again at the end of the year).

To remove that seasonality, I

have introduced the red line. The red line is a 12 month ‘moving average’ trend

line which enables us to look at the ‘de-seasonalised’ housing transaction

numbers, whilst the yellow arrows denote the times of the general elections. It

is clear to see that after the 1997, 2001 and 2005 elections, there was a

significant uplift in number of households sold, whilst in 2010 and 2015, there

was a slight drop in house transactions (i.e.

number of properties sold).

I also wanted to consider what

happened to property prices. In the graph below, I have used that same 12-month

average, housing transactions numbers (in red) and yellow arrows for the dates

of the general elections but this time compared that to what happened to

property values (pink line).

It is quite clear none of the

general elections had any effect on the property values. Also, the timescales between the calling of

the election and the date itself also means that any property buyer’s indecisiveness

and indecision before the election will have less of an impact on the market.

So finally, what does this mean

for the landlords of the 4,701 private rented properties in Aylesbury? Well, as

I have discussed in previous articles (and just as relevant for homeowners as

well) property value growth in Aylesbury will be more subdued in the coming few

years for reasons other than the general election. The growth of rents has

taken a slight hit in the last few months as there has been an overheating of

rental property prices in Aylesbury, making it imperative that Aylesbury

landlords are realistic with their market rents. But, in the long term, as the

younger generation still choose to rent rather than buy ... the prospects, even

with the changes in taxation, mean investing in buy-to-let still looks a good

bet.

To read more about the Aylesbury

property market –visit the Aylesbury Property Market Blog for more information http://theaylesburypropertyblog.blogspot.co.uk/

No comments:

Post a Comment